will long term capital gains tax change in 2021

But those thresholds may change. Remember if you have short-term capital gains they are taxed at the ordinary income tax rates.

Capital Gains Tax What Is It When Do You Pay It

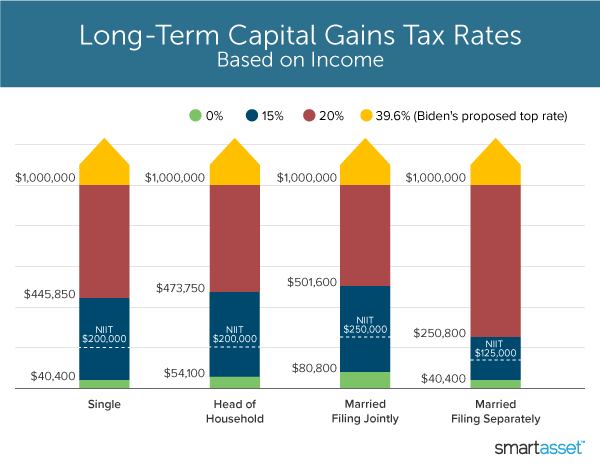

You pay 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451.

. 4 rows Additionally the proposal would impose a 3 surtax on modified adjusted gross income over. Looking at this proposed change in the context of past changes shows that both Democratic and Republican presidents have signed legislation with retroactive tax provisions. If your long-term capital gains take you into a higher tax bracket only the gains above that threshold will be taxed at the higher rate.

Democrats compromise on a prospective effective date of Jan. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. These taxpayers would have to pay a tax rate of 396 on long-term.

There are several potential scenarios in which gain harvesting may not be beneficial. Capital gains tax rates on most assets held for a year or less correspond to. The current long term capital gain tax is graduated.

The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20. Some other types of assets might be taxed at a higher rate. Here are the 2021 long-term capital gains tax rates.

Ad The money app for families. The long-term capital gains tax rate is either 0 15 or 20 as of 2021 depending on your overall taxable income. To take the capital gains top rate to 25 for people earning more than 400000 per year and making.

That applies to both long- and short-term. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. A long-term capital loss you carry over to the next tax year will reduce that years long-term capital gains before it reduces that years short-term capital gains.

President Joe Biden is expected to propose raising the top federal tax rate on long-term capital gains to 396 from 20. Thats the Greenlight effect. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term.

Some other types of assets might be taxed at a higher rate. It would apply to millionaires. A retroactive change may be hard to get through congress because capital gains rates have been.

In other words if your long-term. President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the stepped-up basis on. Increase in the Long-term Capital Gains Tax Rate.

Investors with incomes over 1 million should consider selling appreciated assets in 2021 prior to elimination of the 20 percent preferential rate for. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the. Democrats make the change effective back to April or May though this seems very unlikely.

Long-term gains still get taxed at rates of 0 15 or 20 depending on the. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Hawaiis capital gains tax rate is 725.

While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. On the capital gains side the idea is. 1 2022 or later this is certainly possible.

Long-term capital gains are incurred on appreciated assets sold after more than one year. The bill falls apart and there is no capital gains. May 11 2021 800 AM EDT.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. As a business seller if you are in either the low or mid earning bracket any proposed changes will not affect you so proceed with the sale of your business. President Bidens proposal to increase the capital gains tax has generated tremendous discussion.

This tax increase applies to high-income individuals with an AGI of more than 1 million. Download the app today. One crucial change for the tax year 2021 and beyond is that you can claim the EITC as long as your investment income does not exceed 10000.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Definition 2021 Tax Rates And Examples

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

How Do Taxes Affect Income Inequality Tax Policy Center

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2022 Trust Tax Rates And Exemptions Smartasset

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)